Do You Know What Your Stock Is Worth?

There is an odd trend I've noticed develop over the past 5 years or so.

More and more long-term focused investors - the core audience here - have proudly declared that "valuation is not a major concern" when they choose to buy stocks.

The reasoning for this is that great companies, held for long periods of time, tend to compound returns so voluminously that the original buy price becomes almost unimportant.

The argument goes that you shouldn't wait to buy a great company based on valuation, because you may miss out on many years of compounding if you do.

In this article, I want to show why this is a flawed philosophy, and how even basic valuation work can both protect against major losses and common behavioral traps.

Business Returns vs. Speculative Returns

In the stock market, there are two ways investors can earn a return:

Business Returns are earned when a stock goes up because the underlying business is growing its revenues, assets, profits, and cash flows. A company that grows its sales 20% a year and maintains a constant price-to-sales ratio will deliver a 20% return to its investors every year.

Speculative Returns are when the stock market places a higher multiple on the same business results. This usually happens when sentiment about a particular stock/industry, or the overall economy, turns from negative to less-negative. In the above example, a company can "grow" sales 0% a year, but if the price-to-sales ratio increases from 1.0 to 1.2, the investor still earns a 20% return.

Most long-term investors are concerned with business returns. They plan to hold 3 years or more, and a good company can increase business results by 10% or better every year for decades. This can lead to a doubling, tripling, or more of an initial investment for the patient investor.

Speculative returns are more in the realm of technical analysis and market timing. These returns can be much faster - 20% gains in the span of a week are not unheard of. Of course, neither are 20% losses!

In general, speculative returns can be faster, but business returns will be far more lucrative over a long period of time.

The Risk of Ignoring Speculative Return

While most traders are looking for the quick speculative return with no regard for business quality, many long-term investors don't pay enough attention to it.

This has burned a lot of folks over the past few years.

Take a company like Shopify (SHOP). The prospect for business returns is great: explosive growth in a massive industry, high switching costs, lots of optionality, led by a visionary founder, etc. There is almost no question it will continue to grow sales and cash flows rapidly for the next 5 years or more.

So it should be a great buy, right? Not so fast!

Take a look at Shopify's 2 year stock chart:

Ouch! The stock is down 71%!

But guess what?

Over that SAME period, Shopify's sales have GROWN 79%!

The difference, of course, is speculative return (or in this case, speculative loss). Business-focused investors were spot on - Shopify has grown its business, dramatically. But the decline in P/S ratio from 50 in early 2021 to 8.3 today is devastating. At today's P/S ratio, Shopify would need to expand its revenues by 3.5 times to reach the valuation it had 2 years ago.

Investors who focused only on business returns will likely be waiting a while for that. A little attention paid to price could have avoided this.

Psychology Works Against You

Another risk of ignoring valuation work is psychological.

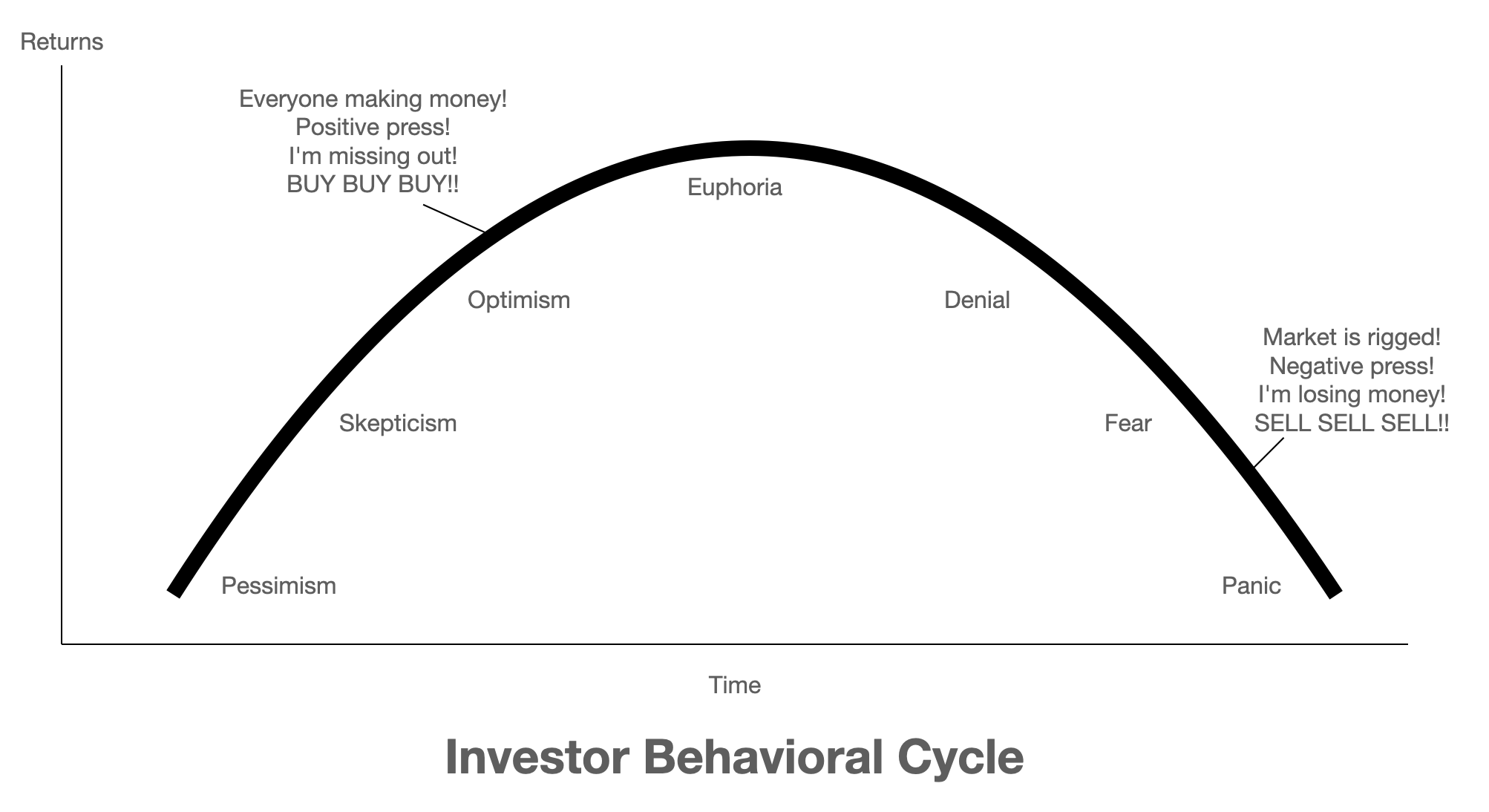

The simple fact is that most investors are far more comfortable buying a stock when the sentiment around it is positive. And they tend to give in to fear and sell right before a market turnaround. Take a look at the typical "Cycle of Market Emotions" graph:

This has been proven over and over again. Even experienced, long-term investors fight this wired-in human tendency.

When you ignore valuation, it is much easier to fall into this trap. You have no price target to anchor your buying decision to. That makes you more likely to buy emotionally, when sentiment is near the "optimism" or "euphoria" stage.

This is simple to illustrate... it is why so many investors plowed money into SaaS and e-commerce stocks in 2020 and 2021, even at objectively inflated valuations! And now, the same folks are selling those same stocks at a huge loss, even though they are far more likely to see gains at current valuations!

It makes little sense logically, but logic and emotion rarely coincide.

Having a price target anchors buying and selling decisions in LOGIC, not EMOTION. This is absolutely key to investing success - it can't be stressed enough!

Conclusion

While it is certainly true that business returns make up the bulk of gains for long-term investors, don't ignore speculative returns! Having a reasonably calculated fair value estimate helps protect you against buying even a great company at a price that is going to prevent a good return. It also grounds your investing decisions in LOGIC instead of EMOTION, preventing you from falling into the classic "Market Emotions" trap.

Information contained on this website represents only the opinions of the author and should not be used as the sole basis for investing decisions. By using this site, you agree to all statements in the Site Policy.

Watch List

| WDAY | -13.18% |

| VEEV | 12.52% |

| PSTG | -7.13% |

| INTU | 14.19% |

| CMG | 31.78% |

| RDDT | 7.17% |

| NTNX | 17.22% |

| CRWD | 76.14% |

| SE | 19.26% |

| SNOW | 5.28% |

| APPF | 6.95% |

Buy List

| PINS | -37.54% |

| ASML | -25.06% |

| SEMR | -37.55% |

| TSM | -43.44% |

| ZETA | -32.89% |

| GOOG | -51.47% |

| NYAX | -30.39% |

| MSFT | -31.81% |

| ODD | -32.30% |

| ASR | -26.98% |

| FLYW | -44.52% |

| HRMY | -60.41% |

| YOU | -37.20% |

| ABNB | -33.55% |

| MELI | -26.26% |

| ADBE | -45.26% |

Hold List

| VTEX | -17.92% |

| CELH | 49.08% |

| TOST | 16.30% |

| CPNG | -14.83% |

| HIMS | -23.69% |

| PAYC | -21.14% |

| MNDY | 7.35% |

| GLBE | -24.43% |

| ZS | 23.06% |

| V | -7.38% |

| ADSK | -2.06% |

| NOW | -1.85% |

| FTNT | -4.90% |

| TEAM | -8.65% |