5 Reasons Recurring Revenue Rules

When reviewing stocks from the Green Screens, we are looking for these characteristics:

- Sustainable organic revenue growth.

- A recurring revenue model.

- Durable competitive advantages ("moats").

- Outstanding management teams.

These are in addition to strong free cash flows and attractive returns on invested capital that the screens themselves are meant to find.

In this article, we're going to focus on the second point: recurring revenues.

What do we mean by recurring revenues? And why are they so important? Let's dig into it!

The Definition of Recurring Revenue

What does recurring revenue mean, exactly?

Recurring revenue is when a single customer pays a company multiple times over a given time period, in a predictable fashion.

The key parts here:

- Single customer: The person or organization that gets billed. It could be a single consumer like you or me, a single company, a government organization, whatever.

- Pays a company multiple times: More than a single billing from company to customer.

- Over a given time period: This varies with the size of the payment. For large payments, this time period may be a few years. For medium size billings, maybe a year. For small payments, a month.

- In a predictable fashion: The KEY piece. This means that the company can reliably predict the number of similar payments from this single customer in the given time period, due to the nature of the business relationship.

Recurring Revenue Business Models

There are a handful of structurally recurring business models.

Frequently, it comes in the form of a subscription model. Here, a service is provided that is billed regularly, usually monthly or annually. The service is provided (and billing continues) until the customer explicitly cancels it.

Another example are consumable products. Many consumers predictably drink a Coca-Cola (KO) every day with lunch, for example. Or visit Starbucks (SBUX) every morning. Or buy Charmin toilet paper (made by Proctor & Gamble (PG)) every month. These are "habit" sales, usually backed up by strong consumer branding.

Yet another form of recurring revenue - and one of the best - is the "toll booth" model. Just like the state takes a fee from every car going over the bridge, some companies are set up to earn a percentage cut based on the amount of business that is transacted through their platforms. Payment processors like Visa (V) and Mastercard (MA) are great examples, as are online marketplaces like Etsy (ETSY) and eBay (EBAY).

So, what makes recurring revenue so great? Let us count the ways...

Reason #1: Lower Business Failure Risk

The first, and probably biggest, reason is that firms with strong recurring revenues have much lower business failure risk than firms that experience wild revenue swings.

Your stock going to $0 is the biggest risk of all, so that's a pretty important advantage!

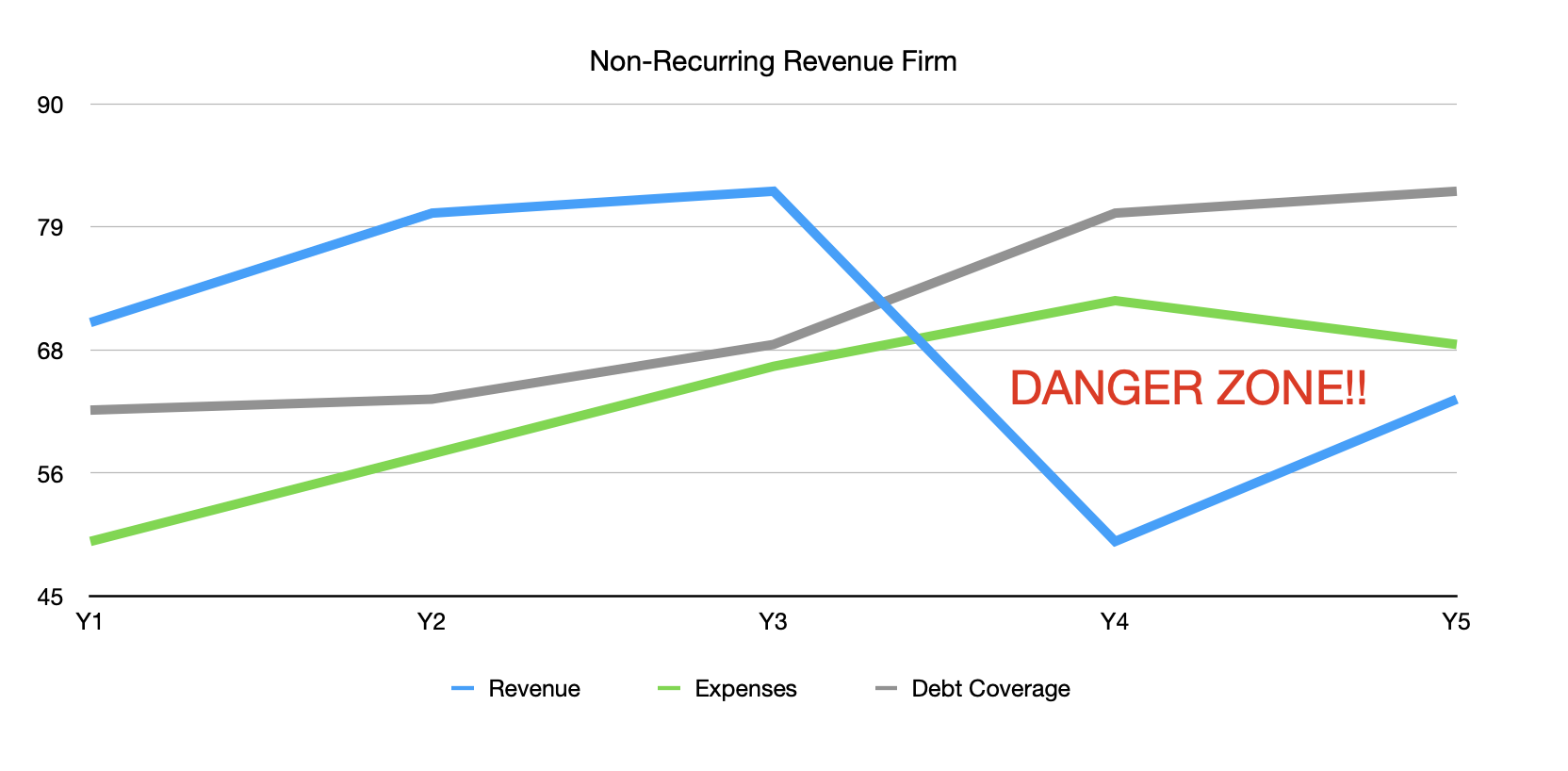

Consider the very simple graphs below. All companies have a minimum level of revenue they need to be profitable. For firms with debt, there's another (higher) sales bar they must clear to avoid breaking debt payback covenants. If revenue falls below either of these lines too far, or for too long, the company faces real bankruptcy risk.

You can see above, recurring revenue firms may experience slight flattening or decline of revenue levels in a tough year, but nothing that puts them in any existential danger. That baseline of predictable sales acts as a bulwark to business challenges.

Non-recurring revenue firms, on the other hand, can easily experience 30, 40, 50% declines in a bad recession. For firms with high fixed costs, or a lot of debt, this creates tremendous business risk.

Reason #2: Increased Predictability

Success in business relies on a lot of things, but two of the most important are good planning and focus.

If you are an executive, having a base of recurring revenue to rely on makes everything easier. You can budget expenses more accurately. You can plan growth initiatives with confidence. You can be a little more aggressive with your balance sheet if you wish, knowing you'll have the cash flow to cover interest payments.

If your business is subject to losing a lot of sales in a year due to macro or competitive pressures, you don't have these luxuries. Budgets can quickly blow up. You have to be far more conservative with the cash you do have, to protect against down swings. There's always the risk of having to scramble just to keep the company running instead of being able to focus on growth and efficiency.

Reason #3: Lower Marketing Costs

A well-known marketing adage is that "it costs 5 times more to acquire a new customer than it does to keep an existing one".

One of the key ways that recurring revenue companies grow is by expanding their business with existing customers (known as "net revenue retention").

For example, say you are a crafts person. You decide to list on Etsy, because of their brand marketing and large network of buyers. Your business starts slow, selling maybe a few items a week. As you build it up to many items a day, Etsy is collecting more and more in selling fees from you, without spending a dime in marketing to do it.

Reason #4: Not Competing for Every Sale

With a recurring revenue model, the company is not competing for every single sale. Usually, customers are paying automatically, through auto-billed subscriptions or automatically deducted fees. Branded consumable goods are often considered "automatic purchases". Think about it - it saves you a lot of time to just grab a case of Coke rather than spend time considering all the options in the soda aisle.

These are almost zero friction sales. No competition was even considered!

On the other hand, in non-recurring sales models, the seller has to win the consumer over its competitors for EVERY SALE. There's no such thing as "zero friction" sales in the automotive, fashion, or casual dining industries, for example. Buyers are considering your competitors every time they look to make a purchase.

Reason #5: Most Long-Term Success Stories Have It

Lastly, and maybe most importantly, virtually all long-term stock market success stories have recurring revenue as a key piece of their business model. Here are just a handful of the top performing 15 stocks since 1960:

Berkshire Hathaway (BRK-B): Makes the bulk of its revenue from insurance and consumables, both of which operate on a recurring revenue model.

Altria (MO): Cigarettes might be the most notorious branded consumable product of all time.

Automatic Data Processing (ADP): One of the original recurring business service models, companies have subscribed to ADP for decades to do their payroll.

Kansas City Southern (KSU): Railroads are one of the oldest "toll booth" models.

Conclusion

Recurring revenue just makes business easier - and safer! That vastly increases your chance of investment success over the long-term. It is one of the key characteristics to look for in a "green dot" stock investment.

Information contained on this website represents only the opinions of the author and should not be used as the sole basis for investing decisions. By using this site, you agree to all statements in the Site Policy.

Watch List

| WDAY | -13.18% |

| VEEV | 12.52% |

| PSTG | -7.13% |

| INTU | 14.19% |

| CMG | 31.78% |

| RDDT | 7.17% |

| NTNX | 17.22% |

| CRWD | 76.14% |

| SE | 19.26% |

| SNOW | 5.28% |

| APPF | 6.95% |

Buy List

| PINS | -37.54% |

| ASML | -25.06% |

| SEMR | -37.55% |

| TSM | -43.44% |

| ZETA | -32.89% |

| GOOG | -51.47% |

| NYAX | -30.39% |

| MSFT | -31.81% |

| ODD | -32.30% |

| ASR | -26.98% |

| FLYW | -44.52% |

| HRMY | -60.41% |

| YOU | -37.20% |

| ABNB | -33.55% |

| MELI | -26.26% |

| ADBE | -45.26% |

Hold List

| VTEX | -17.92% |

| CELH | 49.08% |

| TOST | 16.30% |

| CPNG | -14.83% |

| HIMS | -23.69% |

| PAYC | -21.14% |

| MNDY | 7.35% |

| GLBE | -24.43% |

| ZS | 23.06% |

| V | -7.38% |

| ADSK | -2.06% |

| NOW | -1.85% |

| FTNT | -4.90% |

| TEAM | -8.65% |